Problem 4 5 analyzing transactions into debit and credit parts – In the realm of accounting, Problem 4.5: Analyzing Transactions into Debit and Credit Parts emerges as a fundamental concept that underpins the accurate recording and interpretation of financial events. This exploration delves into the essential principles of debit and credit, providing a comprehensive understanding of their significance in capturing the financial health of an organization.

By mastering the art of analyzing transactions into their constituent debit and credit parts, individuals gain the ability to decipher the language of accounting, unlocking valuable insights into the flow of funds within a business. This knowledge empowers them to make informed decisions, ensuring the integrity and reliability of financial reporting.

Understanding the Concepts of Debit and Credit

In accounting, transactions are recorded using debits and credits. Debit increases an asset or expense account and decreases a liability, equity, or revenue account. Credit decreases an asset or expense account and increases a liability, equity, or revenue account. These rules are essential for maintaining the accounting equation: Assets = Liabilities + Equity.

Here are some examples of debit and credit entries for different types of accounts:

- Assets:Debit to increase (e.g., cash received), credit to decrease (e.g., cash spent)

- Liabilities:Credit to increase (e.g., loan taken), debit to decrease (e.g., loan repaid)

- Equity:Credit to increase (e.g., owner’s investment), debit to decrease (e.g., owner’s withdrawal)

- Revenue:Credit to increase (e.g., sales made), no debit

- Expenses:Debit to increase (e.g., rent paid), no credit

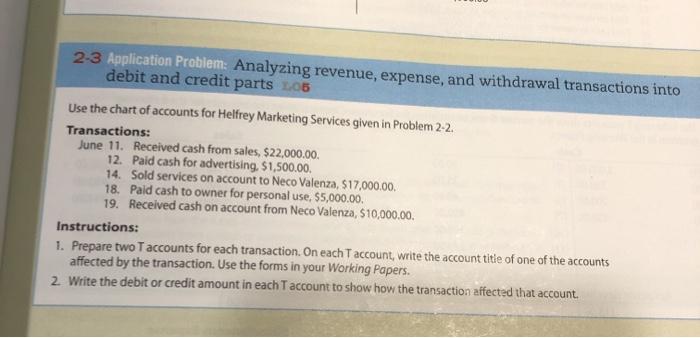

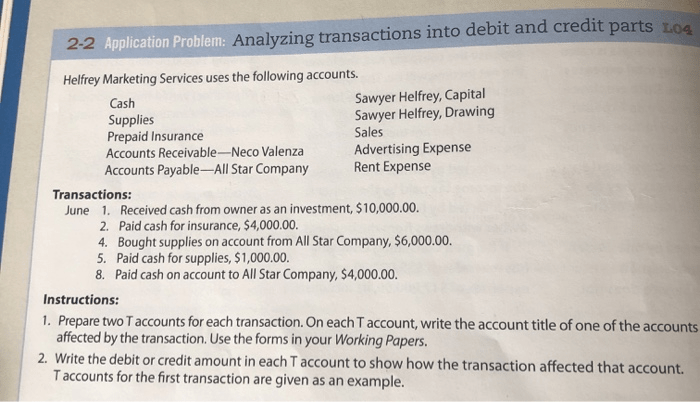

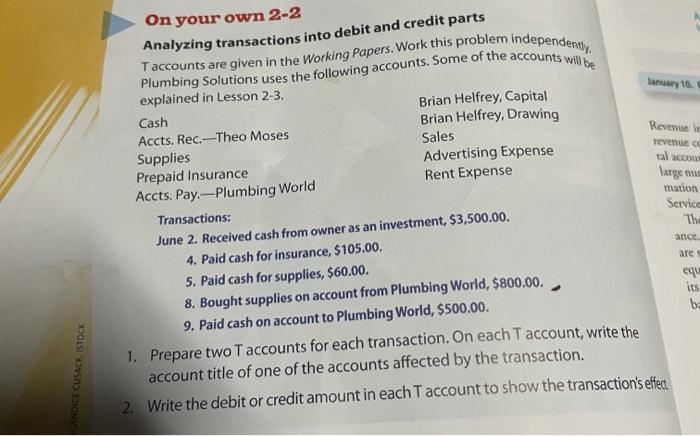

Analyzing Transactions into Debit and Credit Parts

To analyze a transaction into its debit and credit parts, follow these steps:

- Identify the accounts affected by the transaction.

- Determine the nature of the transaction (increase or decrease).

- Apply the debit and credit rules to each account.

Here is a table demonstrating the analysis of common transactions into debit and credit parts:

| Transaction | Debit | Credit |

|---|---|---|

| Cash received from sales | Cash | Sales revenue |

| Equipment purchased on credit | Equipment | Accounts payable |

| Salary expense paid | Salary expense | Cash |

| Owner’s investment in the business | Cash | Owner’s equity |

| Dividend paid to shareholders | Retained earnings | Cash |

Identifying Debit and Credit Errors

Accuracy in analyzing transactions into debit and credit parts is crucial for maintaining the integrity of financial records. Common errors that can occur include:

- Transposition errors:Reversing the digits in a number (e.g., writing 123 instead of 213)

- Omission errors:Failing to record one side of a transaction

- Commission errors:Recording an incorrect amount on one side of a transaction

To identify and correct debit and credit errors, follow these tips:

- Review transactions carefully for any discrepancies.

- Trace the entries back to the original source documents.

- Recalculate the debits and credits to ensure they balance.

Balancing Debit and Credit Parts

The total debits in a transaction must always equal the total credits. This is known as the accounting equation: Assets = Liabilities + Equity. Balancing debit and credit parts ensures that the accounting records are accurate and complete.

To balance debit and credit parts in transactions, follow these rules:

- For every debit, there must be a corresponding credit.

- The total debits in a transaction must equal the total credits.

Here are some examples of balancing debit and credit parts in simple accounting entries:

- Cash received from sales: Debit Cash, credit Sales revenue

- Equipment purchased on credit: Debit Equipment, credit Accounts payable

- Salary expense paid: Debit Salary expense, credit Cash

User Queries: Problem 4 5 Analyzing Transactions Into Debit And Credit Parts

What is the significance of analyzing transactions into debit and credit parts?

Analyzing transactions into debit and credit parts is crucial for maintaining the balance and accuracy of accounting records. It ensures that the total debits equal the total credits, preserving the fundamental accounting equation of Assets = Liabilities + Equity.

How do I identify debit and credit errors?

Debit and credit errors can be identified by examining the accounting equation. If the total debits do not equal the total credits, an error has likely occurred. Additionally, reviewing individual transactions for incorrect account classification or incorrect amounts can help pinpoint errors.

What are some tips for balancing debit and credit parts?

To balance debit and credit parts, ensure that the sum of debits equals the sum of credits in each transaction. Use T-accounts to track the flow of debits and credits for each account, and regularly reconcile accounts to identify any discrepancies.